Isha Bhasin, M. V. Ramana & Sara Nelson

Posted February 17, 2022

SPEAKING AT THE Glasgow Conference of Parties to the United Nations Framework Convention on Climate Change (COP 26), U.S. President Joe Biden pledged to reduce U.S. emissions of greenhouse gases to at least half of 2005 levels by 2030. The ambitious goal is necessary to limit the likely temperature increase due to climate change to within 1.5 degrees Celsius, the preferred target at the 2015 Paris Conference of Parties.

A major bulwark of that plan is the decarbonization of the electricity sector. As John Kerry, the Special Presidential Envoy for Climate, described at the London School of Economics in October 2021: “we’ve committed to reducing our emissions this decade by 50 to 52 percent and heading to net zero, and we’ve laid out a path to get there. That means millions of new electric vehicles. Charging stations from coast to coast. A carbon-free power sector by 2035.”

The emphasis on the power sector makes sense. Compared to other emissions-heavy sectors of the economy, electricity is easier to decarbonize. There are many low-carbon technologies to choose from, and two of them — wind turbines and solar photovoltaics — are the cheapest sources of electricity today in the United States and in many other countries.(1)

Even for other sectors, such as transportation, mainstream narratives of decarbonization lean on technologies like electric vehicles — as reiterated by Kerry. But switching to electric vehicles can only contribute to emissions reductions if the electricity they use comes from a decarbonized power system.

Will the United States succeed in decarbonizing electricity supply by 2035? The answer rests on a bunch of large corporations that dominate electricity generation in the country. Many of these have market capitalizations running into the tens of billions of dollars, often a result of successive mergers and acquisitions. They employ thousands of workers and contribute significantly to local tax bases.

These utility companies have enormous political power, enhanced by the many lobbyists they employ to ensure that no new climate legislation harms their interests — and by government allegiance to capital and corporate profits over its responsibility to the population.

Utilities regularly voice their commitments to climate mitigation, usually by adopting some far-off target date — say, 2050 — by which to achieve “net zero” carbon emissions. The date is late enough to not do anything for the present, and the claims all use the problematic idea of net-zero carbon emissions rather than zero carbon emissions.(2)

Talking about net-zero enables utility companies to rely on unproven technologies and implausible quantities of “offsets” to allow them to continue in a business-as-usual fashion for the foreseeable future — certainly long enough to produce business-as-usual quarterly profit statements and shareholder returns. But they also have more subtle ways of stymying climate action by a variety of means. Or they steer it in directions financially beneficial to themselves.

In Love with Natural Gas

Although coal has largely — although not entirely — fallen out of favor among major utilities, they all continue to rely on natural gas plants. Natural gas is commonly touted as a “bridge fuel” toward a low-carbon future because, when compared to coal, it generates lower carbon dioxide emissions per unit of electricity generated. But burning natural gas still results in carbon dioxide, and additional gas infrastructure guarantees that it will continue to be so for decades.

A further problem is that there is, and will continue to be, leakage of methane from the entire fuel chain required for these plants. A 2020 study estimated 630,000 leaks in U.S. natural gas distribution mains, resulting in approximately 690,000 tons of methane emissions annually.(3) Methane is a potent greenhouse gas that, ton for ton, contributes far more to global warming than carbon dioxide, especially in the short term.

A closer look at the actions of utilities further belies claims that natural gas presents a temporary bridge to a cleaner future. Because utilities seek to profit from their upfront investments, these natural gas plants will be anything but temporary, certainly when viewed in light of the timescales in which climate scientists are calling for emission reductions.

Consider for example Entergy, a corporation with a market capitalization of around $21 billion, as of November 2021. The company was recently in the news concerning the large-scale loss of power in Louisiana following Hurricane Ida. Entergy announced a commitment to achieving net-zero carbon emissions by 2050 across its service territories,(4) but the company is still expanding its fossil fueled fleet — especially natural gas.(5)

Another large utility heavily invested in natural gas is Duke Energy. With a market capitalization of around $80 billion, it is one of the largest power production companies in the United States with over 105 power plants in the Carolinas, Florida and the MidWest. Of these, roughly a half — 51 to be precise — are fossil fuel based.

Its 35 natural gas plants constitute the largest fraction of its fleet, and it still maintains a dozen coal powered plants. In addition, Duke has been expanding into the business of distributing natural gas to homes for heating and other uses.(6)

This isn’t likely to change. In September 2020, Duke submitted several future scenarios to North Carolina’s utilities commission. In all but a token “no-gas” scenario, the utility planned to add up to 9,000 megawatts of natural gas production through 2035. In comparison, its fleet only had 3,000 megawatts of solar and wind power plants as of July 2020.

NextEra Energy, the largest utility in the United States with a market capitalization of nearly $170 billion, derived roughly 50% of its electricity in 2020 from fossil fuels, with natural gas contributing 47.7% Between 2005 and 2020, its generation from natural gas jumped over 70%. Its largest subunit, Florida Power & Light Company, derived 73% of its electricity from natural gas — but even in 2030, it projects a 61% share.

Many of these utilities justify their continued reliance on natural gas by denying that there is any other option. The CEO of Exelon, another large utility with a market capitalization of $53 billion, claimed that he sees “no path to get off natural gas without technological advancements” even while offering a net-zero by 2050 goal.(7)

But this is a false narrative; energy modelers have come up with several scenarios for decarbonizing without the use of natural gas.(8) Instead, utilities promote gas because it sustains their own political power and control against newcomers and distributed generation via solar and wind.

Nuclear as Savior

The other technology that these large utilities are invested in, and tout as a solution to climate change, is nuclear power. Although some environmental activists and climate scientists have argued that nuclear power is necessary for decarbonization,(9) many others (including one of the authors of this article) have disputed that contention.(10)

Despite this dispute, utilities claim they would like to contribute to climate change mitigation by continuing to invest in nuclear power. The problem: many nuclear plants are no longer economically competitive. That nuclear power plants are hugely expensive to build is well known, with construction costs routinely running into tens of billions.

The traditional argument has been that once these costs are paid off, they are cheap to run. As the Tennessee Valley Authority puts it on their webpage: “Nuclear power plants run economically, second only to hydroelectric power in low operating costs.”

That argument is no longer true, because its chief low-carbon competitors — wind and solar — have even lower operating costs. The U.S. Department of Energy, for example, estimates that for each kilowatt of installed capacity, utilities have to spend around $15 per year on solar photovoltaic plants, $26 on onshore wind power plants, and $42 on hydropower plants.(11)

Nuclear plant owners, on the other hand, need to spend around $122 every year. And this is without including the cost of uranium fuel and radioactive waste management. Finally, as long as gas prices are low — which they are, partly as a result of fracking — natural gas plants produce cheap electricity.

These differences in operating costs affect the profits of utility companies that operate in states where electricity is traded on the market. (Other states, where a state regulator approves electricity projects, allow utilities to pass on costs to rate payers.) Nuclear plants routinely fail to make much money on either the energy or capacity markets because the prices offered by other power plants are lower.(12)

The number of nuclear plants this trend affects is quite large. In 2018, Bloomberg analysts estimated that “more than one quarter of all nuclear plants don’t make enough money to cover their operating costs.”

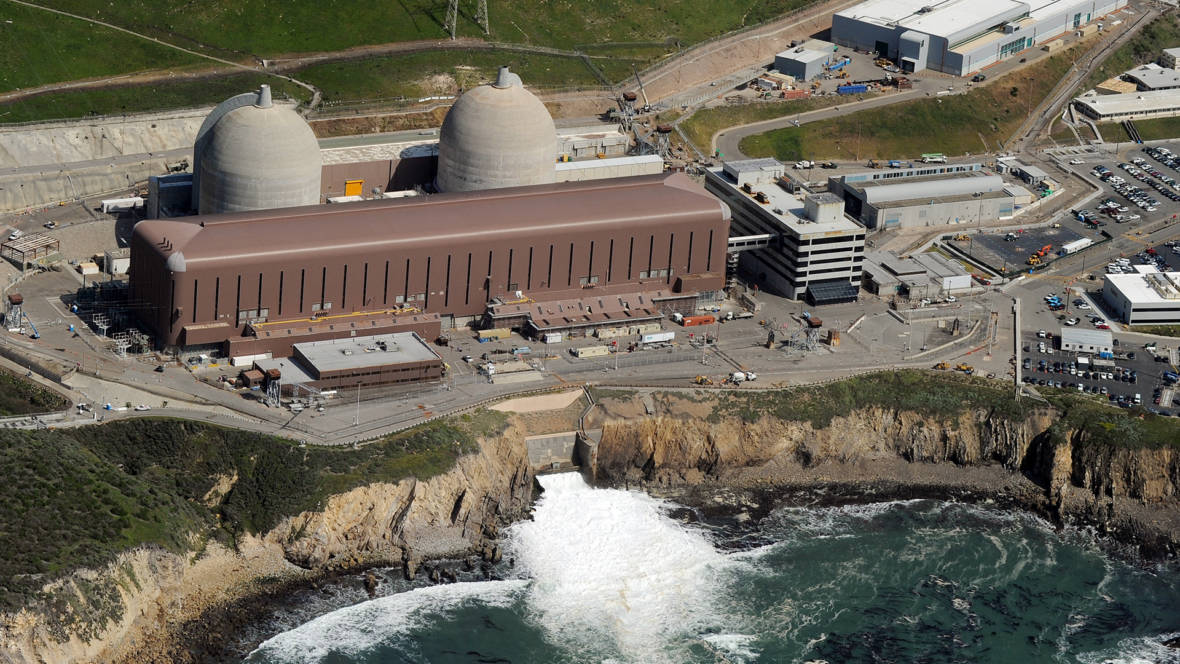

An instructive example is the case of Diablo Canyon, California’s last-operating nuclear power plant. In 2016, the utility Pacific Gas & Electric negotiated a deal with labor unions and environmental groups to retire the plant by 2025.(13)

The Diablo deal came as a shock to some pro-nuclear environmental groups, who claimed that the state was perversely abandoning its largest single source of emissions-free power. But PG&E’s actions were driven by the realization that the plant was inhibiting, rather than supporting, the state’s ambitious decarbonization goals, which mandated 50% renewable power by 2030.(14)

Because nuclear plants are best suited to producing a steady quantity of power, they are not adaptable to the needs of a flexible grid dominated by intermittent solar and wind sources. Even a PG&E-funded report warned that power from Diablo Canyon would become increasingly superfluous after 2025.(15)

The Diablo case shows that nuclear power is by no means a straightforward or cost-effective solution to climate goals. But PG&E and California are exceptions for historical and political reasons. In many other states, utilities have put protecting their nuclear investments over emission reduction goals, and sustain their control over the electricity system.

Lobbying and Corruption

To continue to profit from their nuclear plants, utility companies have managed to get state legislatures to subsidize them. At least five states so far — Illinois, New Jersey, Ohio, Connecticut and New York — have implemented large subsidies to allow utilities to maintain the profitability of nuclear power plants.(16) In all of these cases, the annual financial benefits to these large corporations run in to the hundreds of millions of dollars.

The subsidies — and the enabling legislations that makes consumers pay more for the electricity they use — do not come about by themselves. Electric utilities and various associated organizations have engaged in extensive lobbying and large-scale propaganda campaigns to get state governments to act in their favor. Perversely, these strategies increasingly mobilize the rhetoric of climate mitigation even as they actively work against that goal.

In recent years, Illinois has been a site of intense lobbying by Exelon and its subsidiary Commonwealth Edison (ComEd), primarily to get more nuclear subsidies from the state.

“At least two dozen former Illinois state lawmakers have lobbied on behalf of ComEd or Exelon since 2000,” according to Illinois Policy, an independent public policy organization.

Exelon’s actions in Illinois have been rightly dubbed “the nuclear hostage crisis” by David Kraft of the Nuclear Energy Information Service.(17) The strategy is to threaten to close nuclear plants and lay off all the workers, which would immediately affect local budgets, and thus goad legislators to come to their aid. Thanks to such strategies, earlier this year, the Illinois legislature passed another piece of legislation — for the second time in a decade — that would funnel hundreds of millions of dollars to Exelon.(18)

The subsidies have improved these companies’ financial situation, which in turn contributes to their clout in state and national policy making and their ability to fund advocacy efforts — including by paying politicians tidy sums of money.

FirstEnergy, a $21 billion company now called Energy Harbour, has lobbied for years for a subsidy to maintain its unprofitable nuclear plants.

When lobbying efforts failed to produce subsidies, it resorted to bribery to gain legislative support for House Bill 6, legislation that forces state consumers to pay into something called “the Ohio Clean Air Fund.”

The green language hides the real purpose: to siphon nearly $150 million annually to FirstEnergy to keep its nuclear power plants and two coal-fired power plants operating, while simultaneously gutting Ohio’s renewable energy standards and efficiency programs.

These energy efficiency programs had saved consumers and corporations hundreds of millions of dollars. When citizens tried to organize a referendum to repeal the bill, FirstEnergy indulged in various dirty tactics to thwart this democratic opposition.(19)

In July 2020, the company was charged with the “largest bribery, money-laundering scheme ever perpetrated against the people and the state of Ohio,” resulting in the arrest of Larry Householder, Speaker of the House of the state of Ohio, and four others on charges of racketeering.

Ohio eventually retracted these subsidies. But the political power of FirstEnergy is so great that its stock price has risen roughly 30 percent since the July 2020 charges.

Also in July 2020, Commonwealth Edison (ComEd), a subsidiary of Exelon, was charged with bribery to “Public Official A” in Illinois. Though not named, the filing makes it clear that “Public Official A” is Illinois House Speaker Michael Madigan.

Exelon also finds itself at the centre of another ongoing investigation by the United States Securities and Exchange Commission on charges of corruption related to lobbying for state subsidies and special treatment of nuclear power plants.

For these utilities and their political allies, environmental rhetoric touting nuclear as a clean energy solution provides a thin veneer over tried-and-true dirty politics designed to preserve entrenched political and economic power. It is the latest in a long history of strategies that the industry has used to justify hefty investments in its uncompetitive energy sources.

Their ability to get the public to pay higher costs in order to maintain the profitability of nuclear power plants despite renewable energy sources becoming cheaper all the time — all while mobilizing the language of climate mitigation — testifies to their growing power.

Conclusion

The political and economic power of electricity utilities is a critical factor influencing the prospects for achieving rapid emissions reductions. In a number of contexts, utilities are positioning themselves as leaders on climate action even while working against the most effective and efficient reforms to the energy system.

A specific target has been renewable energy sources, especially when they are not controlled by utilities. Entergy Corporation, for example, has been fighting “competition from other companies or homeowners trying to generate their own power from the sun.”(20) But the opposition to renewables is more general, because they represent a threat to the vested interests of utility companies.

Under capitalism, these companies have strong financial motivations to operate their existing fleets for decades, initially to recoup the money invested and then for profit. Achieving rapid system change of the type necessary to avert climate disaster will require restructuring not only energy generation, but also the political economic system that sustains the power of these. Democratic control over utilities is an essential first step.

Without such actions, broad calls for “climate action” or declarations of climate emergency risk providing further opportunities for powerful private energy incumbents to justify greater subsidy of undesirable energy technologies.

Notes

- Lazard, “Lazard’s Levelized Cost of Energy-Version 15.0” (New York: Lazard, October 2021), https://www.lazard.com/perspective/levelized-cost-of-energy-levelized-cost-of-storage-and-levelized-cost-of-hydrogen/.

back to text - The idea of net-zero emissions has rightly been characterized as a “dangerous trap.” See James Dyke, Robert Watson, and Wolfgang Knorr, “Climate Scientists: Concept of Net Zero Is a Dangerous Trap,” The Conversation, April 22, 2021, http://theconversation.com/climate-scientists-concept-of-net-zero-is-a-dangerous-trap-157368. Nevertheless, electric utilities, the Biden Administration, and other governments, have been quick to adopt the terminology of net-zero.

back to text - Weller, Z. D., Hamburg, S. P., & von Fischer, J. C. (2020). A National Estimate of Methane Leakage from Pipeline Mains in Natural Gas Local Distribution Systems. Environmental Science & Technology, 54(14), 8958–8967. https://doi.org/10.1021/acs.est.0c00437

back to text - Neal Kirby, “Entergy Commits to Achieving Net-Zero Carbon Emissions by 2050,” Entergy Corporation, September 24, 2020, https://www.entergynewsroom.com/news/achieving-net-zero-carbon-emissions-by-2050/.

back to text - Entergy, “2020 Integrated Report,” Our Utility Business, 2021, https://integratedreport.entergy.com/our-utility/our-utility-business.php.

back to text - Reuben Gregg Brewer, “How Duke Energy Corporation Makes Most of Its Money,” The Motley Fool, April 1, 2018, sec. investing, https://www.fool.com/investing/2018/04/01/how-duke-energy-corporation-makes-most-of-its-mone.aspx.

back to text - Josh Siegel, “Why the Largest Producer of Zero-Carbon Electricity Hasn’t Set a 2050 Goal,” Washington Examiner, July 8, 2020, sec. US Energy & Environment Policy News, https://www.washingtonexaminer.com/policy/energy/daily-on-energy-why-the-largest-producer-of-zero-carbon-electricity-hasnt-set-a-2050-goal.

back to text - Arman Aghahosseini, Dmitrii Bogdanov, and Christian Breyer, “A Techno-Economic Study of an Entirely Renewable Energy-Based Power Supply for North America for 2030 Conditions,” Energies 10, no. 8 (August 2017): 1171, https://doi.org/10.3390/en10081171; Arjun Makhijani, “Prosperous, Renewable Maryland: Roadmap for a Healthy, Economical, and Equitable Energy Future” (Takoma Park, MD: Institute for Energy and Environmental Research, 2016), https://ieer.org/resource/energy-issues/prosperous-renewable-maryland-2016/; Mark Z. Jacobson, 100% Clean, Renewable Energy and Storage for Everything (Cambridge, UK: Cambridge University Press, 2020), https://www.cambridge.org/highereducation/books/100-clean-renewable-energy-and-storage-for-everything/26E962411A4A4E1402479C5AEE680B08.

back to text - IAEA, “Climate Change and Nuclear Power 2015” (Vienna: International Atomic Energy Agency, 2015); James Hansen et al., “Nuclear Power Paves the Only Viable Path Forward on Climate Change,” Guardian, December 3, 2015, https://www.theguardian.com/environment/2015/dec/03/nuclear-power-paves-the-only-viable-path-forward-on-climate-change.

back to text - Nikolaus Muellner et al., “Nuclear Energy — The Solution to Climate Change?,” Energy Policy 155 (August 1, 2021): 112363, https://doi.org/10.1016/j.enpol.2021.112363; M. V. Ramana and Robert Jensen, “Nuclear Power Will Not Save Us From Climate Change,” Yes Magazine, November 2, 2018, https://www.yesmagazine.org/planet/nuclear-power-will-not-save-us-from-climate-change-20181102; Arjun Makhijani and M. V. Ramana, “Can Small Modular Reactors Help Mitigate Climate Change?,” Bulletin of the Atomic Scientists 77, no. 4 (2021): 207-14, https://doi.org/10.1080/00963402.2021.1941600.

back to text - EIA, “Cost and Performance Characteristics of New Generating Technologies” (Washington, D. C: Energy Information Administration, Department of Energy, February 2021), https://www.eia.gov/outlooks/aeo/assumptions/pdf/table_8.2.pdf.

back to text - See, for example, WNN, “Exelon Sets Byron Deactivation Date as Illinois Bill Stalls,” World Nuclear News, June 22, 2021, https://www.world-nuclear-news.org/Articles/Exelon-sets-Byron-deactivation-date-as-Illinois-bi.

back to text - Matthew McKinzie, “Diablo Canyon Nuclear Closure Plan: An Important Model,” NRDC (blog), June 22, 2016, https://www.nrdc.org/experts/matthew-mckinzie/diablo-canyon-nuclear-closure-plan-important-model.

back to text - Herman K. Trabish, “Anatomy of a Nuke Closure: How PG&E Decided to Shutter Diablo Canyon,” Utility Dive, July 7, 2016, https://www.utilitydive.com/news/anatomy-of-a-nuke-closure-how-pge-decided-to-shutter-diablo-canyon/421979/.

back to text - MJB&A, “Joint Proposal for the Orderly Replacement of Diablo Canyon Power Plant with Energy Efficiency and Renewables” (Concord, MA: M.J. Bradley & Associates, LLC, June 21, 2016), https://www.pge.com/includes/docs/pdfs/safety/dcpp/MJBA_Report.pdf.

back to text - Cassandra Jeffery and M. V. Ramana, “Big Money, Nuclear Subsidies, and Systemic Corruption,” Bulletin of the Atomic Scientists, February 12, 2021, https://thebulletin.org/2021/02/big-money-nuclear-subsidies-and-systemic-corruption/.

back to text - Catherine Clifford, “Illinois Paid $694 Million to Keep Nuclear Plants Open, Showing Why Greening the Grid Is so Hard,” CNBC, November 20, 2021, sec. Clean Tech, https://www.cnbc.com/2021/11/20/illinois-nuclear-power-subsidy-of-694-million-imperfect-compromise.html.

back to text - Aaron Larson, “Exelon Gets Its Christmas Wish—Illinois Legislation Will Save Nuclear Plants,” Power Magazine, December 2, 2016, https://www.powermag.com/exelon-gets-its-christmas-wish-illinois-legislation-will-save-nuclear-plants/; Clifford, “Illinois Paid $694 Million to Keep Nuclear Plants Open, Showing Why Greening the Grid Is so Hard.”

back to text - Shakiba Fadaie and M. V. Ramana, “A Dirty Battle for a Nuclear Bailout in Ohio,” Bulletin of the Atomic Scientists, April 21, 2020, https://thebulletin.org/2020/04/a-dirty-battle-for-a-nuclear-bailout-in-ohio/.

back to text - Jon Schuppe, “How a Southern Utility Guards Its Monopoly — and Endangers the Power Grid, Critics Say,” NBC News, September 24, 2021, https://www.nbcnews.com/news/us-news/hurricane-ida-power-grid-failure-forces-reckoning-over-entergy-s-n1279971.

back to text

January-February 2022, ATC 216

Comments

One response to “How Electric Utilities Thwart Climate Action: Politics & Power”